refinance closing costs transfer taxes

For example if you spent 15000 on closing costs for a 15-year refinance youd deduct 1000 a year until your loan matures. And while most taxpayers should take the standard deduction over itemizing.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Review Trusted by 45000000.

. Transfer Tax 20 --15 County 5 State First 22000 used to calculate County tax is. Total Deed of Trust Mortgage Tax. State Transfer Tax is 05 of transaction amount for all counties.

In fact the average buyer will pay between 2-5 of. Call us for a quote 2675144630 x1. Review Trusted by 45000000.

Make sure you pay attention to these costs. For example a homeowner who paid 2000 in points on a 30-year mortgage 360 monthly payments could deduct 556 per payment or a total of 6672 for 12 payments. You can write off some closing costs at tax time.

Typically this equates to 110 per 1000 of the sale price throughout the. Many states charge a feetax when a home is. Mortgage refinance closing costs typically range from 2 to 6 of your loan amount depending on your loan size.

Total Closing Costs Recording Fees Transfer Taxes. Mortgage refinance closing costs typically range from 2 to 6 of your loan amount depending on your loan size. Remember that tax laws can change on a year-to.

Ad Compare Your Best Options for Closing Costs in 2020. Your lender does not know what they are doing. Which Particular Closing Costs Can You Deduct.

The total cost of a refinance depends on a number of factors like your lender. 1 day agoWe should keep in mind that rates below 4 are still relatively low by historic benchmarks and we saw rates as high as 5 as recently as September 2018. Closing on your new home.

Generally transfer taxes are paid when property is transferred between two. You closing costs are not tax deductible if they are fees. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes.

Does not apply to refis just purchased in PA. Ad Get Your Custom Mortgage Rate Quote Today. 2400 12 680 034 None.

Ad Get Your Custom Mortgage Rate Quote Today. Note that transfer tax rates are often described in terms of the amount of tax charged per 500. At the county level California has whats known as a documentary transfer tax on property transfers.

6 hours agoThis time last week it was 402. State laws usually describe transfer tax as a set. As you can see closing costs and taxes can cover a wide range of different fees and expenses.

Ad Compare Your Best Options for Closing Costs in 2020. When you buy sell or refinance a home closing costs are a pricey part of the transaction. Total transfer tax.

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. Mortgage closing costs typically range between 2 and 6 of your loan amount. When youre determining what to claim on.

For example in Michigan. Deed of Trust Recording. It will increase in tax year 2022 to 12950 for single filers and 25900 for married couples filing jointly.

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of. Does a lender charge deed transfer taxes in a refinance transaction. A 20-year fixed-rate mortgage refinance of 100000 with todays interest rate of 421 will cost 617 per month in principal and interest.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Closing Costs When Paying All Cash For A Home Financial Samurai

Reducing Refinancing Expenses The New York Times

Understanding Mortgage Closing Costs Lendingtree

Refinancing Thru Better Com What Are The Hidden Fees Or Fees I Can T Avoid Trying To Compare Better 1 75 And 3 229 Up Front Vs A Local Lender 2 5 And 9k Up Front

Understanding Mortgage Closing Costs Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

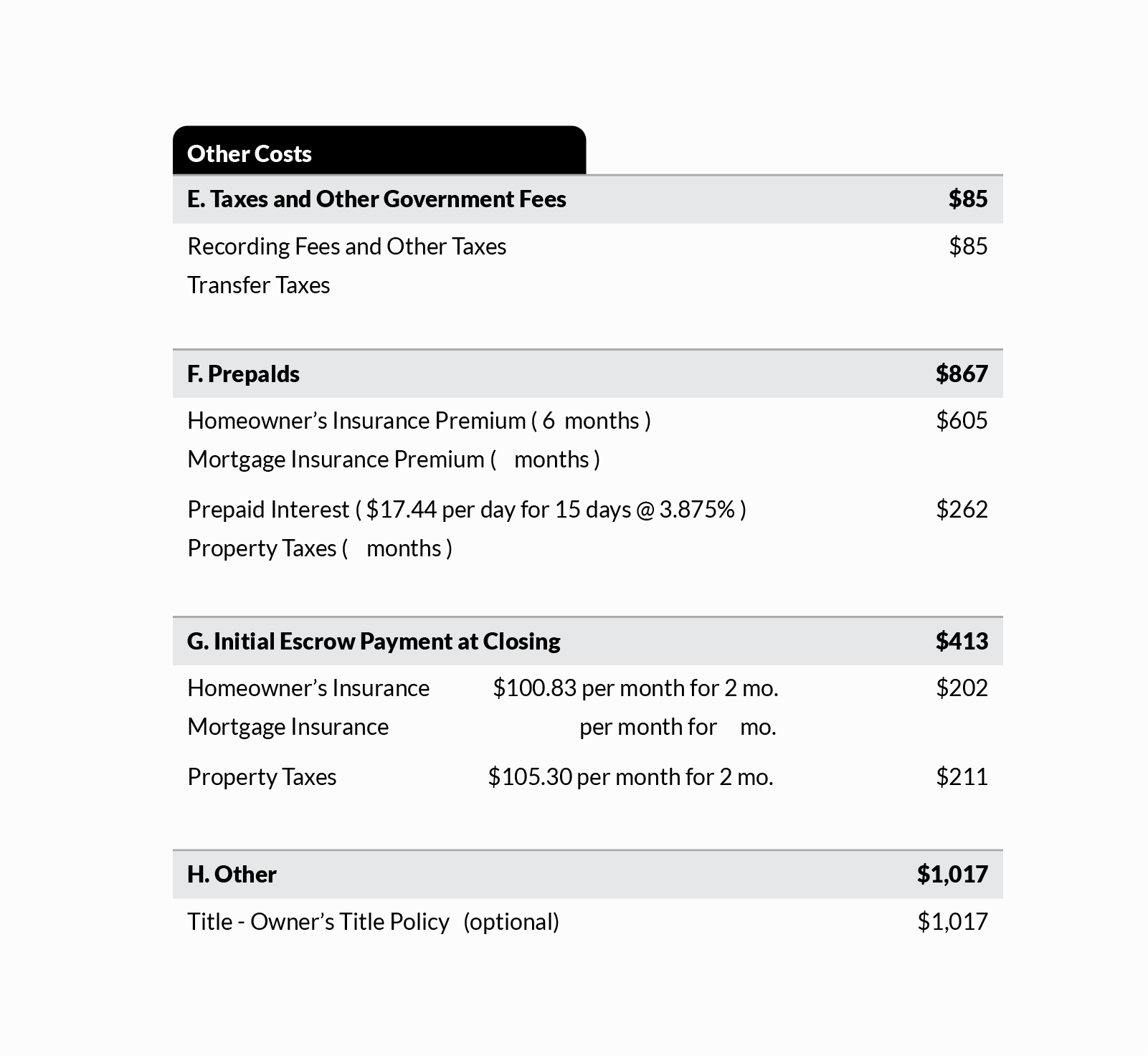

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator